If you are a Jew outside of Eretz Israel this is what you have to deal with:The Jewish Voices on Campus |

|

|

|

Nefesh B’Nefesh: Live the Dream US & CAN 1-866-4-ALIYAH | UK 020-8150-6690 or 0800-085-2105 | Israel 02-659-5800 https://www.nbn.org.il/ info@nbn.org.il It’s time to come home! Nefesh B’Nefesh: Live the Dream 1-866-4-ALIYAH |

|

College Crossroads24 April 2015 http://lazerbrody.typepad.com/lazer_beams/2015/04/college-crossroads.html I am a 20-year-old college sophomore in the US, and lately I have been worrying about whether or not I am on the right path in life. I know I’m still young, but I feel I am ready to be married and start a family, and I live somewhere with very few Jewish males, none of whom are particularly religious. While I’ve always pictured myself as finishing college, lately I am not sure if this is the right thing to do. I was always an excellent student but lately I have been having a very difficult time finishing assignments because my mind is elsewhere, and even so, the liberal arts program I’m in is not likely to lead to many career opportunities. Also, so unbelievably many random things keep going wrong, making it more difficult to continue in school, and I don’t know whether to take this as a sign from Hashem that maybe I should head in a different direction, or just as another challenge in life to overcome. I don’t want to waste any more time if this is not what I should be doing with my life, and end up unmarried, having wasted what should be an exciting time in life on unfruitful studes. Should I spend at least the next two-plus years finishing my BA degree, or is it time to change directions? I would greatly appreciate any advice you might offer. Thank you so much for your time. Wishing you happiness always like you make others happy, Dear Alicia, Good girl – you’ve done a good job of understanding the messages that Hashem has sent you. It’s definitely time for you to seriously search for the right person and to raise a family. The restlessness in your soul is straight from Hashem. A liberal arts program in a university is a waste of your valuable time and money. As far as a livelihood goes, you can take one of many inexpensive aptitude tests available on the web, determine a skill you like, and then pursue a six-month occupational course, such as computers, graphic design, dental tech, or whatever. So, I recommend that you check out of university, move to an area where there are Jewish studies for women your age, and then simultaneously strengthen your Judaism and acquire an occupational skill. On the other hand, my blue-chip advice for you would be to come to Israel, enroll in a women’s seminar for Jewish Studies such as Midreshet Beerot Bat Ayin which I’m sure you’ll love, or EYHAT (Aish Hatora women’s seminary) or Neve Yerushalayim as possible alternatives. That way you’ll be able to strengthen your Judaism and find the exact guy you want. You’ll be a smashing success, G-d willing. May Hashem bless you and lead you in the right path. Feel free to write. With blessings, LB |

|

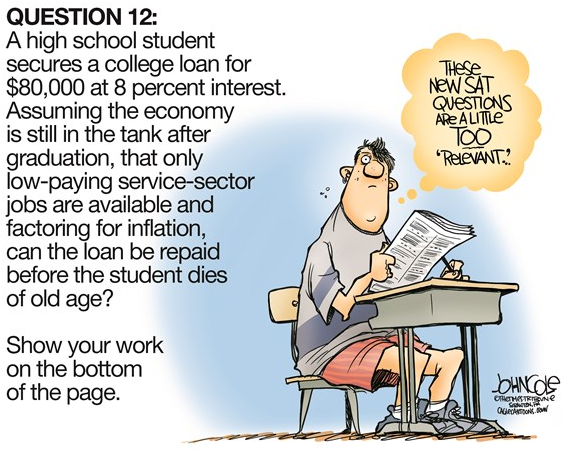

Sliding Confidence: Majority Of Americans Question The Value Of Collegeby Tyler Durden, 01April2023 – https://www.zerohedge.com/markets/sliding-confidence-majority-americans-question-value-college A new Wall Street Journal-NORC poll reveals that a majority of Americans believe a college degree isn’t worth the cost and time. Sliding confidence in the higher education system indicates that the American Dream can be achieved without a college degree. This is an ominous sign for liberal professors teaching meaningless programs, particularly in the humanities.

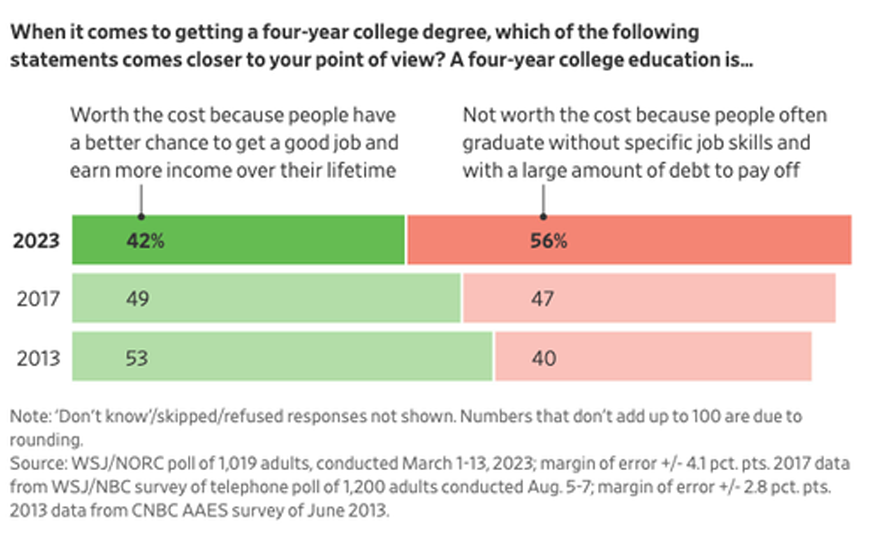

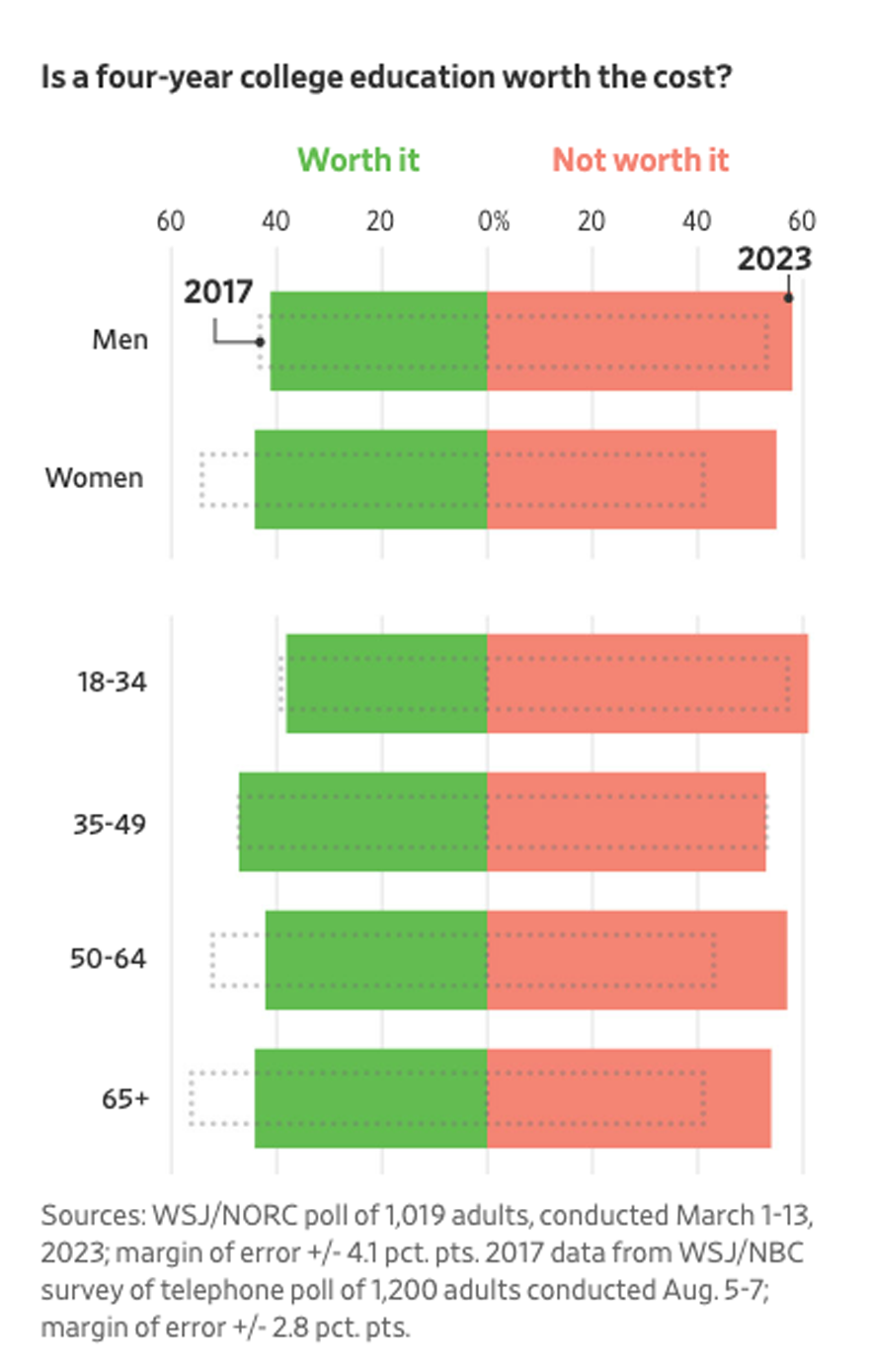

The poll, conducted with NORC at the University of Chicago, found that 56% of Americans believe a four-year degree is a poor investment, while 42% still have confidence in colleges. The majority of this skepticism is found among individuals aged 18-34, and those with degrees are among the groups whose views have soured about college. And why is that? Source: WSJ Well, over 43 million individuals have federal student loans totaling $1.6 trillion. Many of these individuals were assured that obtaining a degree would secure them a high-paying job. Yet, in the current job market, where artificial intelligence is automating vast parts of the economy, some folks with tens of thousands of dollars in student debt are working two and even three low-paying, low-skilled jobs.

For some context of just how quickly the belief in higher education has slumped, in 2013, 53% of Americans had a favorable view of college, while 40% did not. By 2017, the percentage of Americans who believed a four-year degree would result in good jobs fell to 49%, with 47% holding the opposite opinion. Much of the sentiment shift occurred after the 2007–2008 financial crisis.

“These findings are indeed sobering for all of us in higher education, and in some ways, a wake-up call,” said Ted Mitchell, the president of the American Council on Education, which has more than 1,700 institutions of higher education as members.

What bothers us is Mitchell’s next comment:

Maybe the “better job at storytelling” could come if meaningless programs, particularly in the humanities, were removed from the curriculum. Universities need to stop catering to a few radical liberals and teach skills and critical thinking that will translate into a lifetime of success for the student. The current higher education model has failed, and the college grads working as bartenders and or 2-3 jobs are the result of a failed system.

And if universities don’t change their tune and public opinion continues to slide. The bust in the higher education bubble will broaden: Young people realize that a college degree is not always necessary to succeed in today’s economy. Some individuals earn over $100k per year in specialized trades, such as electricians, plumbers, and or welders — many of them have very little debt. |

|

College Student Earns 4.0 GPA, Then Drops Out: “You Are Being Scammed!”by Tyler Durden 22December2016 http://www.zerohedge.com/news/2016-12-21/college-student-earns-40-gpa-then-drops-out-you-are-being-scammed Submitted by Lance Schuttler via TheMindUnleashed.com, Billy Williams just finished his first college semester and did so with the all-impressive 4.0 GPA. Instead of celebrating his accomplishments with friends and family, he decided to drop out of college entirely.

Billy made a facebook post that is now going viral in which he explains his reasoning for dropping out:

Billy is right too that the price of college continues to soar. Ray Franke, a professor of Education at the University of Massachusetts, Boston said:

In 2015, Harvard’s annual tuition and fees (not including room and board) would cost a person $45,278, which is more than 17 times the 1971-72 cost. If annual increases of tuition had simply tracked the inflation rate since 1971, 2016’s tuition would be just $15,189. According to CNBC, college enrollment peaked in 2011, and has been decreasing ever since. This is no doubt in part to a family’s ability to pay the tuition, room and board and other related expenses. For example, in order to pay for a year of college at Harvard today would take the median household income nearly one year of paychecks. Back in 1971, it would have taken about 13 weeks of paychecks per the household median income. Today the student debt is over $1.26 trillion dollars with over 44 million Americans in debt from student loans. 2016’s graduates on average are over $36,000 dollars in debt, which is up 6% from just one year ago. What can be done to alleviate this situation? Why do banks get bailed out (2008 Lehman crisis) for cheating the world, while students must continue to pay a debt? Why is a private institution (The Federal Reserve) in charge of this nation’s money and finances? How will students continue to be able to go to college when the price continues to skyrocket as the federal minimum wage stays stuck at $7.25 an hour? At some point soon, the masses won’t take it anymore from the banking cartel. The education system is in for some major changes very soon. |

|

“The Hit Is Huge”: Colleges Brace For ‘Fatal’ Blow Of Next Fall As Face-To-Face Instruction Uncertainby Tyler Durden 20April2020 https://www.zerohedge.com/economics/hit-huge-colleges-brace-fatal-blow-next-fall-face-face-instruction-uncertain A viral post written by a veteran professor on Medium recently grabbed prospective students’ attention in saying provocatively: “This is a message to all high school seniors (and their parents). If you were planning to enroll in college next fall — don’t.” “No one knows whether colleges and universities will offer face-to-face instruction in the fall, or whether they will stay open if they do,” University of La Verne law professor Diane Klein wrote. “No one knows whether dorms and cafeterias will reopen, or whether team sports will practice and play.” “It’s that simple. No one knows. Schools that decide to reopen may not be able to stay that way. A few may decide, soon, not even to try. Others may put off the decision for as long as possible — but you can make your decision now,” the veteran teacher said, making the case that it’s the worst time ever for families to make the massive financial commitment. After all, who wants to drop an initial $50K or more to potentially sit at home for Fall 2020 and take online classes?  Student sits with her belongings before returning home to Florida from Massachusetts for the rest of the semester, Getty Images. And it’s 100% accurate that colleges and universities are flying through the coronavirus economic ‘pause’ blindly, now slashing budgets for next year and in many instances notifying employees that drastic cuts are coming, including regarding salaries and staffing positions — possibly even reaching into faculty ranks. Colleges and universities across the nation are stuck in financial limbo at a moment that key staffing, faculty contracts, student recruiting, tuition and donor revenue-related decisions are typically made for next year, also as controversy erupts over refusal to refund student housing and campus activity fees. Crucially, endowment values have plunged along with markets. The $600 billion-plus higher education industry is expected to suffer effects of this Spring’s campus shutdowns at least through next Fall, given everything down to campus tours for potential recruits have been canceled, leaving open the crucial question of incoming levels of freshmen and vital tuition revenue for next year. And now it’s not a question of profitability, academic reputation or long-term growth, but of mere survival. In a new report Bloomberg warns this week: “Administrators across the nation increasingly fear their schools may not reopen for the fall semester.” This amid mass cancellations of everything from sports to summer programs and classes, to shuttering of on-campus facilities and student activities. It further details panicked institutions which were already struggling, now fearing amid coronavirus closures and ‘online only’ format, bracing for the “fatal” blow of next Fall, when students may opt to not return and wait things out.

tim-rostan-tweet-20April2020 Gap years for all, says professor in California. https://marketwatch.com/story/high-school-seniors-should-take-next-year-off-in-light-of-the-coronavirus-college-professor-says-2020-04-19?” “The hit is huge,” Larry Ladd, a consultant with the Association of Governing Boards of Universities and Colleges, told Bloomberg. “They will have less financial cushion because that summer revenue is no longer is there.” Worse, high school guidance counselors and parents are well aware of this ‘state of limbo’ and don’t want to risk major investment in their entering college freshmen’s education when there may not be a Fall semester. Bloomberg continues:

Another consultant said “empty dorms is what kills colleges” — precisely the state of things at institutions across the nation at least through summer.  Empty campus amid coronavirus lockdown: California State University, Northridge resembles a ghost town during lockdown. Image source: Danielle Tranter/Medium.com While wealthier schools such as Harvard, Brown and Princeton are expected to weather the storm with greater ease, with some already offering students housing credit and prorated refunds conditioned in their return to campus, the crisis has hit student housing managers and investors hard for the majority of campuses in which the university doesn’t own its own student housing. Some students and families are already suing to get tuition and campus fee refunds. Needless to say this is completely uncharted territory for institutions which of necessity make all their major funding, staffing, and financial decisions some six months before the Fall opening and start of the semester. Like other sectors of the US economy, universities are bracing for the avalanche of debt problems sure to roll down hill into the still very much up-in-the-air Fall semester. |

|

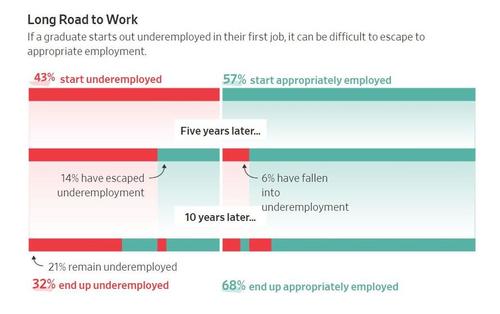

Shocking Data Show 40% Of American College Students Never Graduateby Tyler Durden 12December2018 https://www.zerohedge.com/news/2018-12-12/nearly-40-american-college-students-never-graduate-study-finds As we’ve pointed out time and time again, the notion that going to college guarantees a higher paying job and a better standard of living is a myth (‘millennial Congresswoman’ Alexandria Ocasio-Cortez effectively embodies this myth; she worked as a bartender before launching her upset primary campaign, despite graduating with a degree in economics from Boston University, and has spoken about feeling directionless after graduating with a mountain of student debt). Generally speaking, data suggests that college graduates earn higher incomes, face lower unemployment and happier and healthier than their peers who don’t have a degree. But these general figures mask the fact that millions of degree holders are defaulting on their student loans (one study published in August said 30% of student loans are in their default, or in arrears) and also struggling with underemployment or being stuck working jobs that don’t require a college degree. One million Americans default on their student loans every year. And if defaults continue at their current pace, roughly 40% of borrowers will have defaulted by 2023. With so many flashing red warning signs, the fact that the risks posed by this teetering pile of $1.4 trillion in debt have received only glancing coverage in the financial press is astounding. Coverage of the rising cost of higher education always carefully asserts the old conventional wisdom – that, even with the debt, the underemployment and their resulting stressors (reams of data suggest that American millennials are delaying marriage, family formation and buying a home, largely because of their student loan debt), young Americans are still better off with a degree than without one.

Which is why it was almost refreshing to see the Wall Street Journal publish a story deconstructing these myths. A story that acknowledged – in its opening paragraphs, no less – that “college graduates can end up worse off than people who haven’t gone to college at all.” In fact, 32% of college grads (a group that, we imagine, includes a large number of gender studies majors) end up with jobs that don’t require a degree 10 years after graduation.

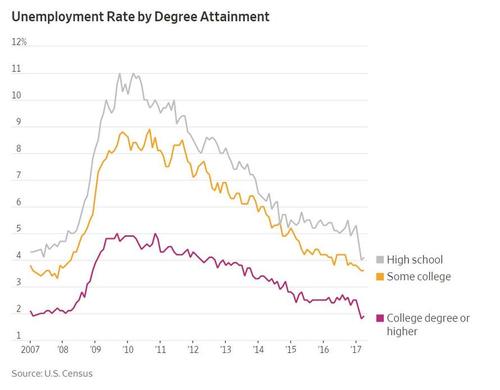

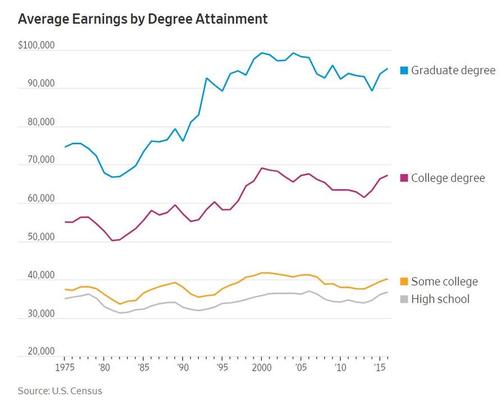

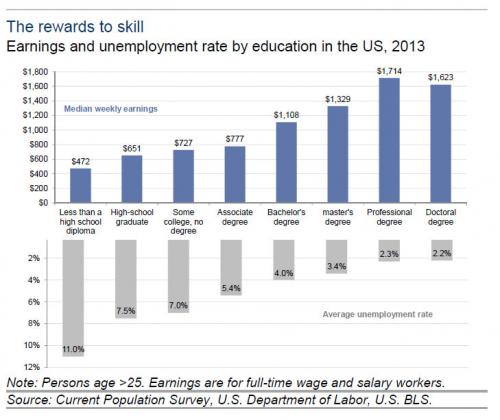

But students who start college, but never finish, are worse off than their peers who earn their degrees (regardless of how long it took to finish). But how many students end up in this predicament? A surprising number, as it turns out. For every 100 students who enroll in university, 40 will never finish. Of these 40, 32 will still need to pay off student loans. Roughly 10 of these 32 – roughly 30% – will eventually default. That’s compared with 5 out of 42 graduates who carry loans. As the chart below shows, students with “some college” struggle with unemployment rates that are nearly as high as students with only a high school degree.  Students with “some college” struggle with unemployment rates that are nearly as high as students with only a high school degree. Their earnings potential is also far closer to those with only a high school diploma than students who finish college.

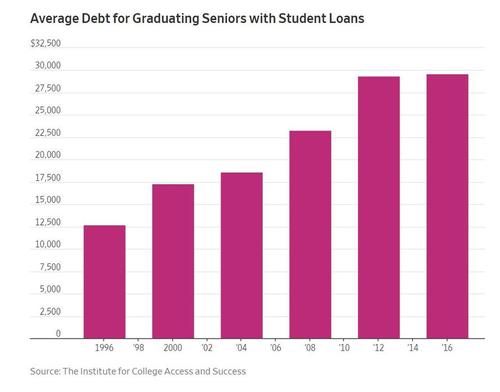

Their earnings potential is also far closer to those with only a high school diploma than students who finish college. The average student loan burden for Americans has nearly doubled over the past 20 years.

To sum up, while a college degree can bestow higher earning capabilities, students shouldn’t enroll without a clear plan for how they’re going to make a living post-grad. |

|

Americans Believe an Internship at Google is More Valuable Than a Degree From HarvardPosted by Mike LaChance 10January2020 https://legalinsurrection.com/2020/01/americans-believe-an-internship-at-google-is-more-valuable-than-a-degree-from-harvard/ “According to a December survey of 2,000 adults”

This is probably true. Even if you don’t end up working at Google, just having it on your resume would open a lot of doors. The College Fix reports:

|

|

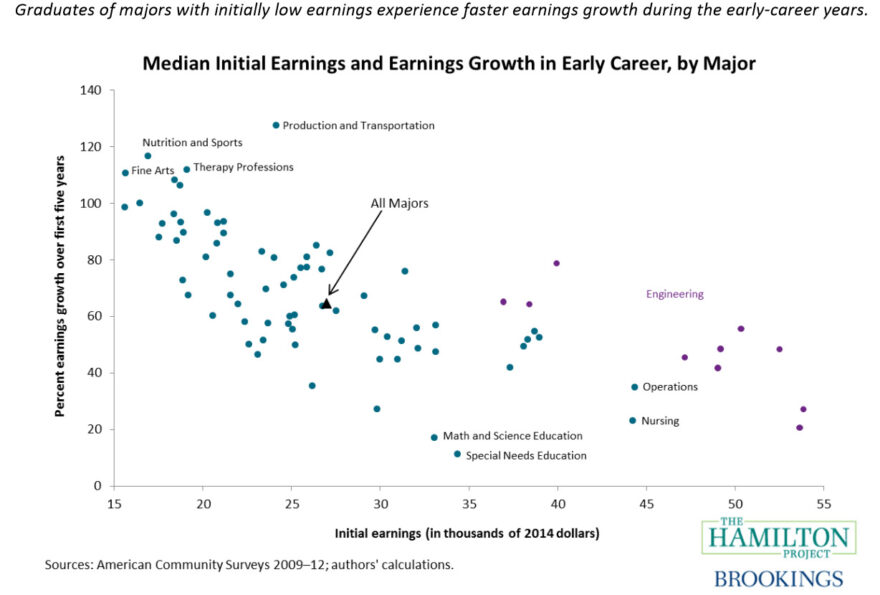

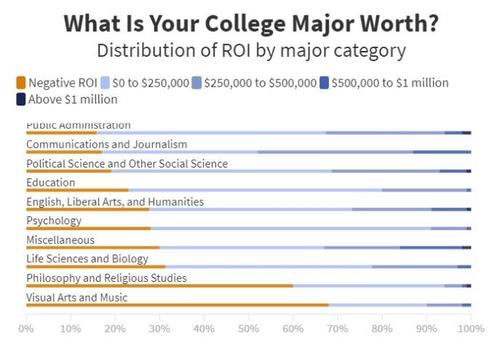

Two-Thirds Of College Grads Regret Their Diploma, Costs And MajorTyler Durden For decades now it’s been a sellers’ market for American universities. Conventional wisdom held that the most important way to succeed in life was to get a college diploma, no matter the cost. Perhaps you’ve noticed university tuitions going up and up. And up. Inexorably. And so has the debt incurred by their students and those students’ parents. It now totals about $1.6 trillion. This being another tedious presidential election season, such a massive debt burden has attracted the attention of feeding politicians seeking to reap votes from younger Americans tasked with repaying the loans they signed up for. As we wrote here earlier this week, Bernie Sanders, Elizabeth Warren, Julian Castro and a growing list of the growing field of candidates have announced various plans to make public school tuitions free and to forgive these massive debts using — you guessed it — new taxes on someone else, namely the well-to-do. Now comes a new wrinkle in these schemes and the universities’ hopes of continuing to reap huge tuition increases. A new poll of nearly a quarter-million Americans has found fully two-thirds of them have buyer’s remorse about their diploma, their major and the higher education experience in general. How much longer do you think folks are going to keep paying such fees that produce such dissatisfaction and unhappiness? Not surprisingly perhaps, the new survey found the top regret was incurring immense debts for that higher education, a debt whose payments run on for many years, causing postponed marriages and families. An estimated 70 percent of college graduates this year finished school with loans to repay averaging $33,000. Even older baby boomers are incurring college debts as they return to school for training in new areas not affected by automation and other labor-saving methods. The survey by PayScale found that even Americans over age 62 had some $86 billion in unpaid debts, theirs or their childrens’. The second largest graduate regret was their choice of college majors. Sen. Marco Rubio has noted in speeches that the occupational demand for Greek philosophers has not been good for about 2,000 years. Three-quarters of humanities graduates expressed regrets over their choice of study areas, tied to their difficulty finding employment in those areas at higher paying jobs enabling them to pay down the debt. Most satisfied were majors in math, science, tech and especially engineering. More than a third of computer science grads and four-in-ten engineering grads had no regrets about their area choice of studies. Interestingly though, teachers expressed the least regrets over their career choices, second least to engineers, despite the chronically low pay of such educators. |

|

Over 25% Of College Degrees Have A Negative Return On Investmentby Tyler Durden 10November2021 – https://www.zerohedge.com/personal-finance/over-25-college-degrees-have-negative-return-investment Authored by Mike Shedlock via MishTalk.com, The median bachelor’s degree has a net ROI of $306,000. But some degrees are worth millions of dollars, while others have no net financial value at all… Is College Worth It?Please consider a Comprehensive Return on Investment Analysis of College Degrees.

None of this is the least bit surprising. Yet, every year tens of thousands of students pick college programs that make no economic sense. And that does not account for dropouts where 100% of programs have negative ROI. Add to that kids pressured into college who would really rather be in a trade. Parents with kids in high school should read the report and so should their kids. It’s quite comprehensive with a dozen charts. * * * |

|

What Gen Z Learned From Millennials: Skip CollegeProfile picture for user Tyler Durden Authored by Andrew Moran via LibertyNation.com, Generation Z is already learning from the millennial generation’s mistakes… For years, millennials have scoffed at the notion of fixing someone else’s toilet, installing elevators, or cleaning a patient’s teeth. Instead, they wanted to get educated in lesbian dance theory, gender studies, and how white people and western civilization destroyed the world. As a result, student loan debt has surpassed the $1 trillion mark, the youth unemployment rate hovers around 9%, and the most tech-savvy and educated generation is delaying adulthood. But their generational successors are not making the same mistakes, choosing to put in a good day’s work rather than whining on Twitter about how “problematic” the TV series Seinfeld was. It appears that young folks are paying attention to the wisdom of Mike Rowe, the American television host who has highlighted the benefits and importance of trade schools and blue-collar work – he has also made headlines for poking fun at man-babies and so-called Starbucks shelters. Will Generation Z become the laughing stock of the world, too? Unlikely.

Z Is Abandoning UniversityA new report from VICE Magazine suggests that Generation Z – those born around the late-1990s and early-2000s – are turning to trade schools, not university and college, for careers. Ostensibly, a growing number of younger students are seeing stable paychecks in in-demand fields without having to collapse under the weight of crushing debt. Because Gen Zers want to learn now and work now, they are abandoning the traditional four-year route, a somewhat precocious response to the ever-evolving global economy. Cosmetologist, petroleum technician, and respiratory therapist are just some of the positions that this generation of selfies, Snapchat, and emoticons are taking. And this is an encouraging development, considering that participation in career and technical education (CTE) has steadily declined since 1990. David Abreu, a teacher at Queens Technical High School, told a class of young whippersnappers at the start of the semester:

While students feel the pressure of attaining a four-year degree in a subject that offers fewer employment opportunities, the blue-collar jobs are out there to be filled. It is estimated that more than one-third of businesses in construction, manufacturing, and financial services are unable to fill open jobs, mainly because of a skills shortage and a paucity of qualifications. This could change in the coming years. The Future Of CollegeOver the last decade or so, the college experience has turned into a circus. At Evergreen College, the inmates ran the asylum. The University of Missouri staff requested “some muscle over here” to suppress journalists. Harvard University has turned into a politically correct institution. What do all these places of higher learning have in common? They’re losing money, whether it’s from fewer donations or tumbling enrollment. Not only are these places of higher learning metastasizing into leftist indoctrination centers, their rates for graduates obtaining employment are putrid. And parents and students are realizing this. With the trend of Gen Zers embracing the trades, the future of post-secondary education might be different. Since colleges need to remain competitive in the sector, they will have to offer alternative programs and eliminate eclectic courses, and the administration will be required to justify their utility. A pupil seeking out a STEM education will not be subjected to the inane ramblings of an ecofeminism teacher or the asinine curriculum of a queer theory course. Moreover, colleges could no longer afford to spend chunks of their budgets on opulent settings. A student interested in the trades is unlikely to be attracted to in-house day spas, luxury dorms, and exorbitant gyms. They want the skills, the tools, and the training to garner a high-paying career without sacrificing 15 years’ worth of earnings just so they could enjoy lobster for lunch twice a week. Generation Smart?Millennials are typically the butt of jokes, known for texting in the middle of job interviews, demanding complicated Starbucks beverages, and ignoring their friends at the restaurant. Perhaps Generation Z doesn’t want to experience the same humiliation and stereotypes. This could explain why they are dismissing the millennial trends and instead adopting common sense, conservatism, tradition, and anything else that is contrary to those who need to be coddled. The next 20 years should be fascinating. In 2039, Ryder, who prefers the pronoun “xe,” is employed as a barista, a position he claims is temporary to pay off his student debt. He lives on his friend’s sofa, still protests former President Donald Trump, and spends his disposable income on tattoos. In the same year, Frank operates an HVAC business, owns his home without a mortgage, and has a wife and three children who enjoy their summer weekends at the ballpark with the grandparents.

One went to college for feminist philosophy, the other went to trade school. You decide who. |

|

Four Reasons Why College Degrees Are Becoming Uselessby Tyler Durden 15June2017 http://www.zerohedge.com/news/2017-06-15/four-reasons-why-college-degrees-are-becoming-useless Authored by Jonathan Newman via The Mises Institute, Students are running out of reasons to pursue higher education. Here are four trends documented in recent articles: Graduates have little to no improvement in critical thinking skillsThe Wall Street Journalreported on the troubling results of the College Learning Assessment Plus test (CLA+), administered in over 200 colleges across the US. According to the WSJ, “At more than half of schools, at least a third of seniors were unable to make a cohesive argument, assess the quality of evidence in a document or interpret data in a table”. The outcomes were the worst in large, flagship schools: “At some of the most prestigious flagship universities, test results indicate the average graduate shows little or no improvement in critical thinking over four years.” There is extensive literature on two mechanisms by which college graduates earn higher wages: actually learning new skills or by merely holding a degree for the world to see (signaling). The CLA+ results indicate that many students aren’t really learning valuable skills in college.

Shouting matches have invaded campuses across the countryIt seems that developing critical thinking skills has taken a backseat to shouting matches in many US colleges. At Evergreen State College in Washington, student protests have hijacked classrooms and administration. Protesters took over the administration offices last month, and have disrupted classes as well. It has come to the point where enrollment has fallen so dramatically that government funding is now on the line. The chaos at Evergreen resulted in “anonymous threats of mass murder, resulting in the campus being closed for three days.” One wonders if some of these students are just trying to get out of class work and studying by staging a campus takeover in the name of identity politics and thinly-veiled racism. The shouting match epidemic hit Auburn University last semester when certain alt-right and Antifa groups (who are more similar than either side would admit) came from out of town to stir up trouble. Neither outside group offered anything of substance for discourse, just empty platitudes and shouting. I was happy to see that the general response from Auburn students was to mock both sides or to ignore the event altogether. Perhaps the Auburn Young Americans for Liberty group chose the best course of action: hosting a concert elsewhere on campus to pull attention and attendance away from both groups of loud but empty-headed out-of-towners. Of the students who chose not to ignore the event, my favorite Auburn student response was a guy dressed as a carrot holding a sign that read, “I Don’t CARROT ALL About Your Outrage.”

Trade schools and self-study offer better outcomes for manyCollege dropouts are doing just fine, bucking the stereotype. Some determined young people are skipping college altogether to pursue their business ideas. Many are also choosing trade schools, which require less time and tuition money, but graduates end up with a specific set of skills. Trade school graduates leave school prepared for the industry they enter, where they can earn much higher wages than many four-year degree-holders. Young men in particular are leaving colleges in droves. Over the past decade, 30% of male freshmen dropped out before starting a second year. The journalists, psychologists, and sociologists who comment on this trend can’t figure out how to fit it into a narrative [emphasis mine]:

Notice the call for helping these poor young men “thrive in higher education” that precedes a small anecdote about one man who dropped out and ended up just fine. Later in the same article, the author says that young men shouldn’t assume they will do well if they drop out, but then equivocates by turning it into a gender wage-gap problem to explain how some men do seem to turn out fine after dropping out:

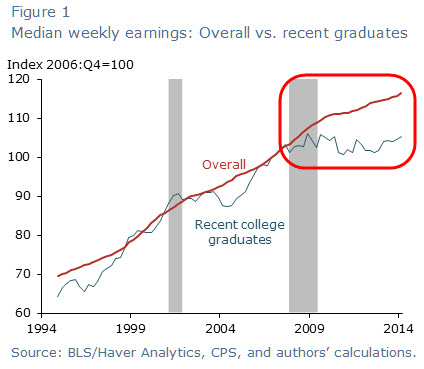

Tuition is increasing, but future earnings are decreasingIn another recent WSJarticle, we see the financial consequences of these trends. While tuition keeps climbing across the country, the prospective earnings of graduates aren’t keeping up. There is a lot of variation across colleges and majors, but the overall trend is that the returns to a four-year degree are decreasing. Since students are just getting started in life, it means that they must borrow to pay for these expensive degrees that don’t guarantee higher earnings. Total student loans are at $1.3 trillion and climbing. These loans have no collateral and cannot be dissolved through bankruptcy.

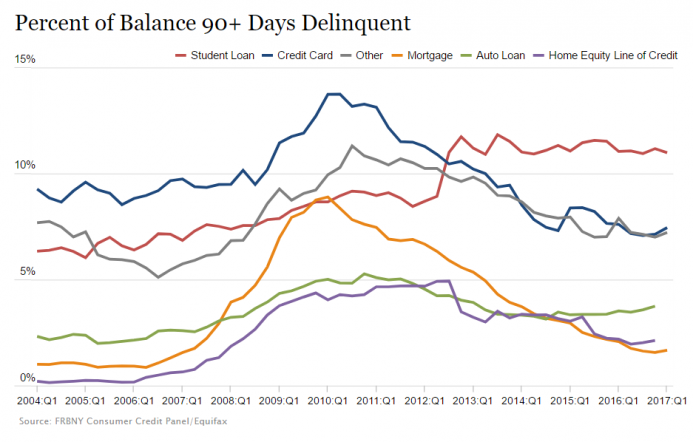

The New York Fed tracks the delinquency rate for different types of loans. As of the first quarter of 2017, total student loan debt was increasing the most and had the highest delinquency rate. These trends are unsustainable. The higher education system seems to be suffering from both economic and cultural issues, but these two types of problems often cause each other in a feedback loop. The ultimate cause for both of them is political. |

|

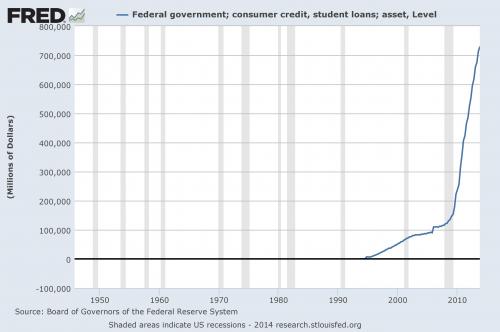

What The Fed Won’t Tell You About Student DebtSubmitted by Tyler Durden on 17May2014 https://www.zerohedge.com/news/2014-05-17/what-san-fran-fed-did-not-tell-you-about-student-debt Two weeks ago, the San Fran Fed released “research” on the topic of whether “it is still worth going to college.” What it “found” was that “Earning a four-year college degree remains a worthwhile investment for the average student…. The average college graduate paying annual tuition of about $20,000 can recoup the costs of schooling by age 40. After that, the difference between earnings continues such that the average college graduate earns over $800,000 more than the average high school graduate by retirement age… We show that the value of a college degree remains high, and the average college graduate can recover the costs of attending in less than 20 years. Once the investment is paid for, it continues to pay dividends through the rest of the worker’s life, leaving college graduates with substantially higher lifetime earnings than their peers with a high school degree.” What was left unsaid, of course, is that the SF Fed merely was tasked with goalseeking a study that seeks to perpetuate America’s most exponential chart. The one showing federal student loans, which as we showed recently just hit an aggregate total of over $1.1 trillion, increasing 12%, or $125 billion, from this time last year.

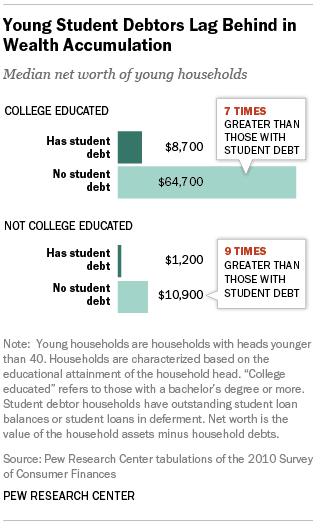

As we have shown in the past (here and here), since US consumers have largely given up on the two conventional forms of leverage – credit cards and mortgages – no (taxpayer-funded) expense will be spared to promote the myth that (federal-debt funded) higher education is the way to go. Alas, the San Fran Fed ignored something important. This is how we concluded our article: “Perhaps for the San Fran Fed to be taken seriously one of these years, it will actually do an analysis that covers all sides of a given problem, instead of just the one it was goalseeked to “conclude” before any “research” was even attempted.” Namely the impact of debt. And since the Fed can’t be bothered with an objective analysis covering both sides the most important debt issue for America, we go to Pew which recently concluded an analysis on the impact of student debt and found that “Student debt burdens are weighing on the economic fortunes of younger Americans, as households headed by young adults owing student debt lag far behind their peers in terms of wealth accumulation.” At the big picture level, there is nothing surprising here, but the extent to which student debt burdens cripple wealth formation and accumulation was indeed stunning and explains why the Fed had to explicitly omit the impact of debt on one’s long-term well-being, because the result is nothing short of shocking.

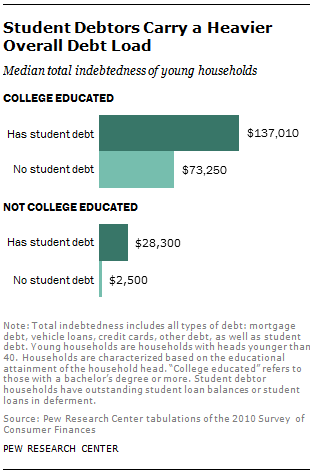

Another not surprising tangent: those who borrow to pay for college, are most likely to borrow for everything else too. Among the young and college educated, the typical total indebtedness (including mortgage debt, vehicle debt and credit cards, as well as student debt) of student debtor households ($137,010) is almost twice the overall debt load of similar households with no student debt ($73,250). Among less-educated households, the total debt load of student debtors ($28,300) is more than ten times that of similar households not owing student debt ($2,500). Either that, or households which do not have to borrow to pay for college, most likely don’t have to pay for other expenses. In other words, Pew uncovered the profound tautology that if you are rich, you remain rich, which all those others in the lower and middle classes who aspire to reach the upper class thanks to easy and cheap debt, only bury themselves even more in their aspirational approach to purchase class status with debt. As American Interest observes about the Pew research, “the report revealed an alarming trend: While the total debt burden of households without student debt has declined since 2007, the total debt burden of households with student debt has increased. This holds true for all student debtors, whether they completed college or not.

By now we doubt anyone doubts the severity of the problem. What may be confusing, however, is the problem itself which after Pew’s far better research can be concluded as follows:

In any case, the conclusion is clear: if one is rich enough to be able to afford college tuition, room and board without requiring debt, college is a no brainer. For everyone else the payoff of a college education, especially in an economy where college grads are certainly not assured quality paying jobs, is far less clear and in fact as Pew finds, one is better off not borrowing to go to college. Of course, the direct implication here is also very clear, if very sad: the rich who can afford college, will end up becoming even richer thanks to the better-paying jobs their degree affords them, while everyone else will either drown under the weight of student loans, or simply be relegated to far less-paying jobs during their career. And while the Fed can be confused about this conclusion, not even the Fed is confused that it itself is the reason for this record and increasing disparity between rich and poor. So the next time you curse someone for making college so expensive you need hundreds of thousands in debt to pay for it, or are cursing the fate that made you into a 40+ year old debt slave, aim those curses where they belong: Alan Greenspan, Ben Bernanke and now, obviously, Janet Yellen. Because for all the “confusion” about America’s record wealth divide that French socialists have to reprise the role of Karl Marx in the process selling blockbuster books to a new generation of pre-communists, the fundamental reason for the greatest class divide in history is a very simple three letter word: the Fed. |

|

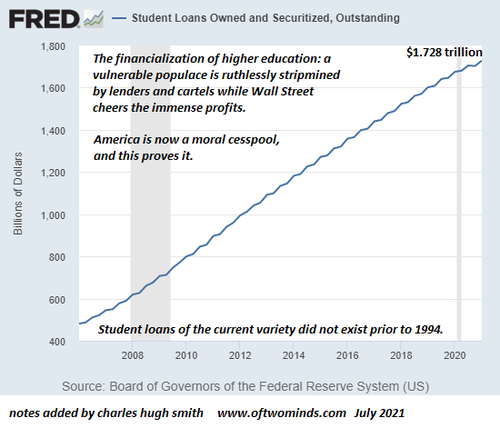

America Is A Moral Cesspool, And Student Loans Prove ItBY TYLER DURDEN 26July2021 – https://www.zerohedge.com/political/america-moral-cesspool-and-student-loans-prove-it Authored by Charles Hugh Smith via OfTwoMinds blog, If America somehow managed to educate millions of college students without burdening them with $2 trillion in debt in 1993, why is it now “impossible” to do so, even as America’s wealth and gross national product (GDP) have both rocketed higher over the past 27 years?

Predators thrive on Americans’ short memories. Student loans in their present scale did not exist prior to 1994. According to the Federal Reserve FRED database, the student loan balance was zero in 1993. From zero in 1993 to $1.728 trillion in 2021: this is the predatory financialization of higher education which has enriched lenders, Wall Street and the Higher Education Cartel. As I’ve noted before, such parasitic rapaciousness would have been criminal a few generations ago; now it’s cheered as a reliable source of profits by Wall Street and treated as business as usual by the corporate-owned media.

If America somehow managed to educate millions of college students without burdening them with $2 trillion in debt in 1993, why is it now “impossible” to do so, even as America’s wealth and gross national product (GDP) have both rocketed higher over the past 27 years? America is now a moral cesspool, and student loans prove it. Note that the $1.728 trillion isn’t the entire load of debt crushing students; that’s only the securitized student loans. Wily sharpsters have found all sorts of private-debt niches which they sell as “student loans” but which are actually consumer loans. Then there’s the credit card debt from card issuers giving students “student-only cards.” Add it all up and the total likely exceeds $2 trillion. Monopolies, cartels, profiteers and insiders always have a raft of excuses and justifications for their exploitation of the powerless, and all those profiting from the $2 trillion have the usual excuses plus a novel set of noble-sounding academic rationalizations. Journalist Matt Taibbi lays waste to one slice of the student loan racket in The Trillion-Dollar Lie (courtesy of correspondent Joel W.), the legal foundation of the entire parasitic swindle: “students can’t escape student loans in bankruptcy court.” But suppose the legal edifice were to recognize that universities are not “non-profits” but are instead a racketeering cartel? While crying poor, universities have pursued a construction boom of trophy buildings without precedent and piled up slush funds with hundreds of millions of dollars extracted from student debt-serfs. If this doesn’t make your blood boil, then you must be swimming laps in America’s moral cesspool, praising the putrid stench as “the smell of money.” It doesn’t have to be this way. Way back in 2012 I laid out a way to offer 4-year university degrees for 10% of the current cost (minus living expenses, which accrue whether you’re a student or not) in my book The Nearly Free University. There are models which would produce better educational results at a fraction of the current bloated cost. To all those swimming laps in America’s moral cesspool, a few words of warning:

|

|

Thanks To Their Student Loans, Millennials Expect To Die In Debtby Tyler Durden 14January2019 – https://www.zerohedge.com/news/2019-01-14/thanks-their-student-loans-millennials-expect-die-debt Adulting, the now common idiom goes, is hard. And to many millennials, the grim realization that debt will always be part of their lives is not making it any easier. In some cases, their debt load is so soul-crushing they expect to die without ever paying what they owe back. So how much does this problem have to do with the higher-education crisis the country is facing? As it turns out, everything. According to a study by Northwestern Mutual, educational loans are the leading source of debt for millennials ages 18 to 24. And according to a CreditCards.com report, over 60 percent of millennials aged 18 to 37 are completely unsure when, or if, they will be able to pay their debt off. Among those who responded they are uncertain about their ability to pay off debt, 20 percent said they expected to die in debt. But to those with only credit card debt, the prospects aren’t as grim, as 79 percent of millennials said they had a plan to pay it all off, expecting to be completely debt-free by age 43. While many of the news outlets reporting on these findings urge young people to get a plan in place so they can pay off their debt, the reality is that government’s push to give everyone a college education is what has greatly contributed to young people’s debt load. And what’s worse, degreesare not actually helping many young people get a job. Will bureaucrats and those who pushed for more government-subsidized education ever admit they created a monster that has finally gotten out of control? Government’s Role in Millennials’ Bad ChoicesWhen government and elected officials push college education as a right, they imply that the government has the duty to help provide it to the populace. With grants, subsidies, and easy, risk-free loans going out to 17-year-olds with no credit history, young people think pursuing the career of their dreams is a piece of cake. But once school is out and all they have is a diploma, they finally realize things weren’t as easy as they expected. The problem is that when government enters the picture and makes it easier for consumers to pay for college, it artificially increases the demand for college. With a greater number of students demanding higher education, schools have to raise their prices. After all, they have a limited supply of what they offer. As explained by economist Ryan McMaken, “Were it not for the subsidized loans and — in the case of public colleges — directly subsidized tuition, the number of students able to afford such degrees would shrink considerably.” With fewer students knocking on their doors, colleges would have to slash costs and, consequently, prices, just so they could fill up their empty classrooms. But to bureaucrats, the solution doesn’t lie with letting the market work. Instead, they want more government interference. Pushing for better loan deals, more regulation, or penalties for students who can’t pay the loans back, bureaucrats and their supporters are only worsening the problem they created. In an age in which more and more employers are ditching degree requirements, paying for a piece of paper proving you finished college is becoming increasingly unnecessary. The government continues to head in the wrong direction, giving young people the idea that college is for everyone. If this doesn’t prove the government doesn’t have our best interests at heart, nothing else does. |

|

Is College A Waste Of Time And Money?Tyler Durden on 27March2014 https://www.zerohedge.com/news/2014-03-27/guest-post-college-waste-time-and-money Submitted by Michael Snyder of The Economic Collapse blog,

Are you thinking of going to college? If so, please consider that decision very carefully. You probably have lots of people telling you that an “education” is the key to your future and that you will never be able to get a “good job” unless you go to college. And it is true that those that go to college do earn more on average than those that do not. However, there is also a downside. At most U.S. colleges, the quality of the education that you will receive is a joke, the goal of most colleges is to extract as much money from you and your parents as they possibly can, and there is a very good chance that there will not be a “good job” waiting for you once you graduate. And unless you have someone that is willing to pay your tuition bills, you will probably be facing a lifetime of crippling student loan debt payments once you get out into the real world. So is college a waste of time and money? In the end, it really pays to listen to both sides of the debate. [wpex Read more] Personally, I spent eight years at U.S. public universities, and I really enjoyed those times. But would I trade my degrees today for the time and money that I spent to get them?  As SF Fed notes, Median starting wages of recent college graduates have not kept pace with median earnings for all workers over the past six years. This type of gap in wage growth also appeared after the 2001 recession and closed only late in the subsequent labor market recovery. However the wage gap in the current recovery is substantially larger and has lasted longer than in the past. The larger gap represents slow growth in starting salaries for graduates, rather than a shift in types of jobs, and reflects continued weakness in the demand for labor overall. Absolutely. Right now, Americans owe more than a trillion dollars on their student loans, and more than 124 billion dollars of that total is more than 90 days delinquent. It is a student loan debt bubble unlike anything that we have ever seen before, and now even those that make their living from this system are urging reform. For example, consider what a law professor at the University of Tennessee recently wrote for the Wall Street Journal…

When a lot of young Americans graduate from college and can’t find a decent job, they are told that if they really want to “be successful” that what they really need is a graduate degree. That means more years of education, and in most cases, even more debt.

But by the time many of these young achievers get through college and graduate school, the debt loads can be absolutely overwhelming…  Debt burdens vary a lot across majors. In the sixth year of repayment, typical drama, music, religion and anthropology majors are still devoting more than 10 percent of their earnings to loan repayment. Other majors with fairly high early repayment burdens include philosophy, psychology and education. By contrast, engineering, computer science, economics and nursing majors are paying 6 percent or less of earnings in their sixth year.

In particular, many are questioning the value of a law school education these days. Law schools are aggressively recruiting students even though they know that there are way, way too many lawyers already. There is no way that the legal field can produce enough jobs for the huge flood of new law school graduates that are hitting the streets each year. The criticism has become so harsh that even mainstream news outlets are writing about this. For instance, the following comes from a recent CNN article…

In America today, approximately two-thirds of all college students graduate with student loan debt, and the average debt level has been steadily rising. In fact, one study found that “70 percent of the class of 2013 is graduating with college-related debt – averaging $35,200 – including federal, state and private loans, as well as debt owed to family and accumulated through credit cards.” That would be bad enough if most of these students were getting decent jobs that enabled them to service that debt. But unfortunately, that is often not the case. It has been estimated that about half of all recent college graduates are working jobs that do not even require a college degree. Could you imagine that? Could you imagine investing four or five years and tens of thousands of dollars in a college degree and then working a job that does not even require a degree? And the really sick thing is that the quality of the education that most college students are receiving is quite pathetic. Recently, a film crew went down to American University and asked students some really basic questions about our country. The results were absolutely stunning…

I have posted the YouTube video below. How in the world is it possible that college students in America cannot name a single U.S. senator?… These are the leaders of tomorrow? That is a frightening thought. If parents only knew what their children were being taught at college, in most instances they would be absolutely horrified. The following is a list of actual college courses that have been taught at U.S. colleges in recent years… -“What If Harry Potter Is Real?” -“Lady Gaga and the Sociology of Fame” -“Invented Languages: Klingon and Beyond” That last one is my favorite. The truth is that many of these colleges don’t really care if your sons and daughters learn much at all. They just want the money to keep rolling in. And our college students are discovering that when they do graduate that they are woefully unprepared for life on the outside. In fact, one survey found that 70% of all college graduates wish that they had spent more time preparing for the “real world” while they were still in college. In America today, there are more than 300,000 waitresses that have college degrees, and close to three out of every ten adults in the United States under the age of 35 are still living at home with Mom and Dad. Our system of higher education is not working, and it is crippling an entire generation of Americans. So what do you think? Do you believe that college is a waste of time and money? Comments:

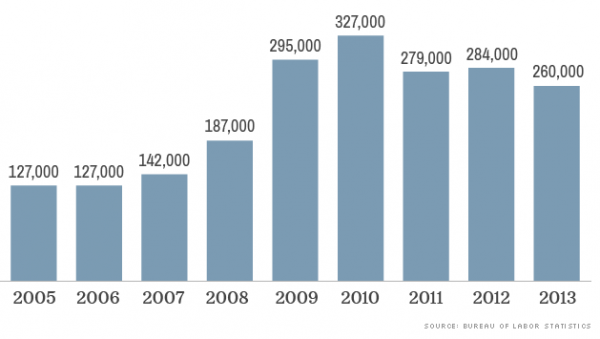

Here’s At Least 260,000 Reasons Why College Isn’t Worth ItSubmitted by Tyler Durden on 01April2014 https://www.zerohedge.com/news/2014-04-01/heres-least-260000-reasons-why-college-isnt-worth-it Just last week we asked “Is college waste of time and money?” It appears, based on the latest data from the BLS, that for all too many, it absolutely is. As CNN Money reports, about 260,000 people who had a college or professional degree made at or below the federal minimum wage of $7.25 last year.  From the U.S. Bureau of Labor Statistics, about 260,000 people who had a college or professional degree made at or below the federal minimum wage of $7.25 last year. From the U.S. Bureau of Labor Statistics, about 260,000 people who had a college or professional degree made at or below the federal minimum wage of $7.25 last year.A total of 21 states, including New Jersey, New York and Connecticut recently, have higher minimum wage floors than the federal level of $7.25 per hour Experts point to shifts in the post-recession labor market as the reason for so many college graduates in low-paying jobs.

Related: Surprising minimum wage jobs

At the same time, median household income has also dropped by more than $4,000 since 2000, according to the Census Bureau.This has fed the growing number of college educated workers protesting for higher pay. Debbra Alexis, a 27-year-old Victoria’s Secret employee with a bachelor’s degree in health sciences, gathered more than 800 signatures in support of her campaign for higher pay at her New York City store. The store, part of L Brands (LB), ended up giving across-the-board raises of about $1 to $2 per hour to all workers in the Herald Square store. Related: Millennials turn up heat against low wages A group of Kaplan tutors in New York City also formed a union to bargain for better wages. And fast food worker Bobby Bingham, who got a bachelor’s degree from University of Missouri in Kansas City, works four part-time low-wage jobs just to barely scrape by.

The consensus among these workers is that they thought pursuing pricey degrees would buy them access into the middle class. But that has been far from the reality in the wake of the recession.

Bingham told CNNMoney. “A degree looks very nice, but I don’t have a job to show for it.”[wpex Read more] comments:

|

|

The Upside Case Of A College Education In One ChartSubmitted by Tyler Durden on 03/28/2014 15:54 -0400 https://www.zerohedge.com/news/2014-03-28/upside-case-college-education-one-chart Late last night we presented a scathing report highlighting the extensive downside case why a college education may be best described as a “waste of time and money.” But surely it can’t be all “cons” – after all, with student debt now well over an all time high $1 trillion (ignoring that a substantial amount of that notional is used for anything but) there must be a reason why year after year record amounts of young adults scramble into the warm embrace and soothing promises about the future of a college education… which has never cost more. Why? In order to present a balanced view, on the chart below we show the conventional wisdom about the “pros” of higher learning. We leave it up to our readers to decide if the lifetime NPV of loan outflows is enough to make up for the increased weekly wages and so called greater career opportunities arising from having a piece of paper with some Latin scribbles on it. |

|

9 Of The Top 10 Occupations In America Pay An Average Wage Of Less Than $35,000 A YearSubmitted by Tyler Durden on 04April2014 https://www.zerohedge.com/news/2014-04-04/9-top-10-occupations-america-pay-average-wage-less-35000-year Submitted by Michael Snyder of The Economic Collapse blog, According to stunning new numbers just released by the federal government, that we detailed yesterday, nine of the top ten most commonly held jobs in the United States pay an average wage of less than $35,000 a year. When you break that down, that means that most of these workers are making less than $3,000 a month before taxes. And once you consider how we are being taxed into oblivion, things become even more frightening. Can you pay a mortgage and support a family on just a couple grand a month? Of course not. In the old days, a single income would enable a family to live a very comfortable middle class lifestyle in most cases. But now those days are long gone. In 2014, both parents are expected to work, and in many cases both of them have to get multiple jobs just in order to break even at the end of the month. The decline in the quality of our jobs is a huge reason for the implosion of the middle class in this country. You can’t have a middle class without middle class jobs, and we have witnessed a multi-decade decline in middle class jobs in the United States. As long as this trend continues, the middle class is going to continue to shrink.[wpex Read more] The following is a list of the most commonly held jobs in America according to the federal government. As you can see, 9 of the top 10 most commonly held occupations pay an average wage of less than $35,000 a year…

Overall, an astounding 59 percent of all American workers bring home less than $35,000 a year in wages. So if you are going to make more than $35,000 this year, you are solidly in the upper half. But that doesn’t mean that you will always be there. More Americans are falling out of the middle class with each passing day. Just consider the case of a 47-year-old woman named Kristina Feldotte. Together with her husband, they used to make about $80,000 a year. But since she lost her job three years ago, their combined income has fallen to about $36,000 a year…

There is a common assumption out there that if you “have a job” that you must be doing “okay”. But that is not even close to the truth. The reality of the matter is that you can even have two or three jobs and still be living in poverty. In fact, you can even be working for the government or the military and still need food stamps…

There are so many people that are really hurting out there. Today, someone wrote to me about one of my recent articles about food price increases and told me about how produce prices were going through the roof in that particular area. This individual wondered how ordinary families were going to be able to survive in this environment. That is a very good question. I don’t know how they are going to survive. In some cases, the suffering that is going on behind closed doors is far greater than any of us would ever imagine. And often, it is children that suffer the most…

You can see some photos of that poor little boy right here. I hope that those abusive parents are put away for a very long time. Sadly, there are lots of kids that are really suffering right now. There are more than a million homeless schoolchildren in America, and there are countless numbers that will go to bed hungry tonight. But if you live in wealthy enclaves on the east or west coasts, all of this may sound truly bizarre to you. Where you live, you may look around and not see any poverty at all. That is because America has become increasingly segregated by wealth. Some are even calling this the “skyboxification of America”…

Nobody should talk about an “economic recovery” until the middle class starts growing again. Even as the stock market has soared to unprecedented heights over the past year, the decline of middle class America has continued unabated. And most Americans know deep inside that something is deeply broken. For example, a recent CNBC All-America Economic Survey found that over 80 percent of all Americans consider the economy to be “fair” or “poor”. Yes, for the moment things are going quite well for the top 10 percent of the nation, but that won’t last long either. None of the problems that caused the last great financial crisis have been fixed. In fact, they have gotten even worse. We are steamrolling toward another great financial crisis and our leaders are absolutely clueless. When the next crisis strikes, the economic suffering in this nation is going to get even worse. As bad as things are now, they are not even worth comparing to what is coming. So I hope that you are getting prepared. Time is running out. |

|

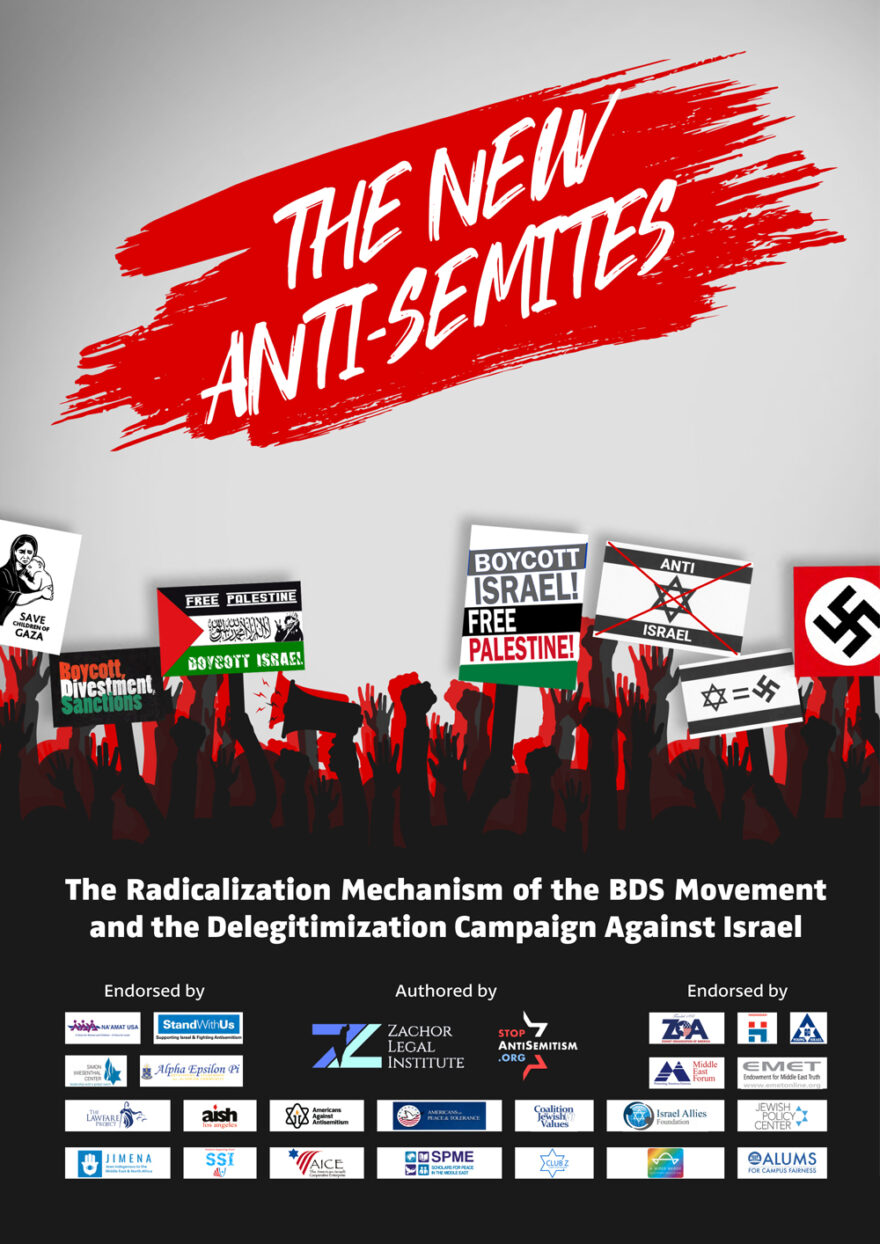

Is it time for Jews to walk away from universities?Given the alarming spike in campus anti-Semitism, maybe it’s time the Jewish community in the US built its own higher education system.By Abraham H. Miller Published on 24July2020 https://www.israelhayom.com/opinions/is-it-time-for-jews-to-walk-away-from-universities/ [JerusalemCats Comments: Yes, it is time for Jews to walk away from universities in the Diaspora and attend Israeli Universities in Israel, as Israelis. It is time for Aliyah!! (Immigration to Israel)] Nefesh B’Nefesh: Live the Dream US & CAN 1-866-4-ALIYAH | UK 020-8150-6690 or 0800-085-2105 | Israel 02-659-5800 https://www.nbn.org.il/ info@nbn.org.il In response to an alarming spike in campus anti-Semitism, the Jewish community is debating whether it should walk away from colleges and universities that once restricted its children with quotas and now openly permits their harassment. You can talk about systemic and structural racism, but on American campuses, African Americans and other select minorities have powerful advocates for their causes. Whether through the office of residence life or that of the dean of diversity and inclusion, the slightest hint that the campus environment is unwelcoming in any way to certain minorities will be met with the strongest possible response, even to the point of shredding traditions of free speech or academic freedom in the process. The very notion of an unwelcoming environment mobilizes the campus bureaucracy and large segments of the student community through “intersectionality” to close ranks, denounce the offense and root out the offenders. Contrast that with the environment Jewish students face. They receive eviction notices under their doors. They must put up with the phony and vile accusations during “Israel Apartheid Week” that are linked to an upsurge in anti-Semitic incidents, including violence. They can be told, as they are at San Francisco State University, that they are not welcome if they are Zionists. Intimidation – The Aftermath of the National SJP Conference

They can be accused of having undue influence, as a Muslim faculty member at University of California, Berkeley rattles off a list of buildings named after Jewish donors, as if there is something sordid in Jewish donations, while ignoring that Middle East studies departments are flush with foreign money. They must endure endless attempts within student governments to get the institution to boycott, divest, and sanction Israel, known as BDS, that even if affirmed will never be lawfully implemented, knowing that the function of such is to demonize Israel and Jews. Few administrators speak for them. No part of the intersectionality community will come to their defense. The campus bureaucracy doesn’t care if they feel welcome. In fact, a complaint to the dean of diversity and inclusion will often result in a lecture telling them they are responsible of their own harassment. Courses in Middle East politics are all too frequently taught by Palestinian sympathizers who use the classroom to stir up anti-Semitism by demonizing Israel and Jews. So, is it time for Jews to leave the university? It isn’t a new question. Some 30 years ago, fundamentalist Christians and conservatives began asking themselves the same question. We might talk about diversity but finding a fundamentalist Christian or political conservative in a faculty position in a major university is a rarity. The environment actively discourages them. There is no such thing as intellectual diversity, especially in the current climate of groupthink. A university no longer needs classrooms, dormitories, bars, recreation facilities and athletic teams. Even before the COVID-19 outbreak, distance learning was on the ascent. The British in the 19th century created college learning through correspondence for the overseas bureaucracy. Now the BBC‘s partner, the Open University, awards degrees to the doctoral level through online learning. There will always be elite schools with exalted reputations that will draw in-residence students, but most second-tier colleges and universities are hardly worth the outrageous tuition, oppressive debt, or mindless indoctrination in political correctness and anti-Semitism. They will be replaced by the Internet. So, let Jews use their contributions, building funds, and endowments to create their own universities of whatever model or models they deem appropriate. Learning is second nature to us. We are not only the People of the Book, but the people who love books. Given structural and systemic anti-Semitism on campus, any Jewish parents who send their children to a secular Jewish college or university should be given a tax credit, both federal and state, for being constructively unable to use the pubic education system because of systemic anti-Semitism.

The system, in general, does not want our children, and much of it is going to collapse anyway. It is only a matter of time before the bricks and mortar of many universities are replaced by the Internet. We should get ahead of the curve by the judicious use of technology and financing to build our own system.

|

|

Move to Israel, Get a Free Degree |

|

America The Illiterateby Tyler Durden 08September2016 https://www.zerohedge.com/news/2016-09-07/america-illiterate Authored by Chris Hedges in Nov 2008, via Strategic-Culture.org, We live in two Americas. One America, now the minority, functions in a print-based, literate world. It can cope with complexity and has the intellectual tools to separate illusion from truth. The other America, which constitutes the majority, exists in a non-reality-based belief system. This America, dependent on skillfully manipulated images for information, has severed itself from the literate, print-based culture. It cannot differentiate between lies and truth. It is informed by simplistic, childish narratives and clichés. It is thrown into confusion by ambiguity, nuance and self-reflection. This divide, more than race, class or gender, more than rural or urban, believer or nonbeliever, red state or blue state, has split the country into radically distinct, unbridgeable and antagonistic entities. There are over 42 million American adults, 20 percent of whom hold high school diplomas, who cannot read, as well as the 50 million who read at a fourth- or fifth-grade level. Nearly a third of the nation’s population is illiterate or barely literate. And their numbers are growing by an estimated 2 million a year. But even those who are supposedly literate retreat in huge numbers into this image-based existence. A third of high school graduates, along with 42 percent of college graduates, never read a book after they finish school. Eighty percent of the families in the United States last year did not buy a book. The illiterate rarely vote, and when they do vote they do so without the ability to make decisions based on textual information. American political campaigns, which have learned to speak in the comforting epistemology of images, eschew real ideas and policy for cheap and reassuring personal narratives. Political propaganda now masquerades as ideology. Political campaigns have become an experience. They do not require cognitive or self-critical skills. They are designed to ignite pseudo-religious feelings of euphoria, empowerment and collective salvation. Campaigns that succeed are carefully constructed psychological instruments that manipulate fickle public moods, emotions and impulses, many of which are subliminal. They create a public ecstasy that annuls individuality and fosters a state of mindlessness. They thrust us into an eternal present. They cater to a nation that now lives in a state of permanent amnesia. It is style and story, not content or history or reality, which inform our politics and our lives. We prefer happy illusions. And it works because so much of the American electorate, including those who should know better, blindly cast ballots for slogans, smiles, the cheerful family tableaux, narratives and the perceived sincerity and the attractiveness of candidates. We confuse how we feel with knowledge. The illiterate and semi-literate, once the campaigns are over, remain powerless. They still cannot protect their children from dysfunctional public schools. They still cannot understand predatory loan deals, the intricacies of mortgage papers, credit card agreements and equity lines of credit that drive them into foreclosures and bankruptcies. They still struggle with the most basic chores of daily life from reading instructions on medicine bottles to filling out bank forms, car loan documents and unemployment benefit and insurance papers. They watch helplessly and without comprehension as hundreds of thousands of jobs are shed. They are hostages to brands. Brands come with images and slogans. Images and slogans are all they understand. Many eat at fast food restaurants not only because it is cheap but because they can order from pictures rather than menus. And those who serve them, also semi-literate or illiterate, punch in orders on cash registers whose keys are marked with symbols and pictures. This is our brave new world. Political leaders in our post-literate society no longer need to be competent, sincere or honest. They only need to appear to have these qualities. Most of all they need a story, a narrative. The reality of the narrative is irrelevant. It can be completely at odds with the facts. The consistency and emotional appeal of the story are paramount. The most essential skill in political theater and the consumer culture is artifice. Those who are best at artifice succeed. Those who have not mastered the art of artifice fail. In an age of images and entertainment, in an age of instant emotional gratification, we do not seek or want honesty. We ask to be indulged and entertained by clichés, stereotypes and mythic narratives that tell us we can be whomever we want to be, that we live in the greatest country on Earth, that we are endowed with superior moral and physical qualities and that our glorious future is preordained, either because of our attributes as Americans or because we are blessed by God or both. The ability to magnify these simple and childish lies, to repeat them and have surrogates repeat them in endless loops of news cycles, gives these lies the aura of an uncontested truth. We are repeatedly fed words or phrases like yes we can, maverick, change, pro-life, hope or war on terror. It feels good not to think. All we have to do is visualize what we want, believe in ourselves and summon those hidden inner resources, whether divine or national, that make the world conform to our desires. Reality is never an impediment to our advancement. The Princeton Review analyzed the transcripts of the Gore-Bush debates, the Clinton-Bush-Perot debates of 1992, the Kennedy-Nixon debates of 1960 and the Lincoln-Douglas debates of 1858. It reviewed these transcripts using a standard vocabulary test that indicates the minimum educational standard needed for a reader to grasp the text. During the 2000 debates, George W. Bush spoke at a sixth-grade level (6.7) and Al Gore at a seventh-grade level (7.6). In the 1992 debates, Bill Clinton spoke at a seventh-grade level (7.6), while George H.W. Bush spoke at a sixth-grade level (6.8), as did H. Ross Perot (6.3). In the debates between John F. Kennedy and Richard Nixon, the candidates spoke in language used by 10th-graders. In the debates of Abraham Lincoln and Stephen A. Douglas the scores were respectively 11.2 and 12.0. In short, today’s political rhetoric is designed to be comprehensible to a 10-year-old child or an adult with a sixth-grade reading level. It is fitted to this level of comprehension because most Americans speak, think and are entertained at this level. This is why serious film and theater and other serious artistic expression, as well as newspapers and books, are being pushed to the margins of American society. Voltaire was the most famous man of the 18th century. Today the most famous “person” is Mickey Mouse. In our post-literate world, because ideas are inaccessible, there is a need for constant stimulus. News, political debate, theater, art and books are judged not on the power of their ideas but on their ability to entertain. Cultural products that force us to examine ourselves and our society are condemned as elitist and impenetrable. Hannah Arendt warned that the marketization of culture leads to its degradation, that this marketization creates a new celebrity class of intellectuals who, although well read and informed themselves, see their role in society as persuading the masses that “Hamlet” can be as entertaining as “The Lion King” and perhaps as educational. “Culture,” she wrote, “is being destroyed in order to yield entertainment.” “There are many great authors of the past who have survived centuries of oblivion and neglect,” Arendt wrote, “but it is still an open question whether they will be able to survive an entertaining version of what they have to say.” The change from a print-based to an image-based society has transformed our nation. Huge segments of our population, especially those who live in the embrace of the Christian right and the consumer culture, are completely unmoored from reality. They lack the capacity to search for truth and cope rationally with our mounting social and economic ills. They seek clarity, entertainment and order. They are willing to use force to impose this clarity on others, especially those who do not speak as they speak and think as they think. All the traditional tools of democracies, including dispassionate scientific and historical truth, facts, news and rational debate, are useless instruments in a world that lacks the capacity to use them. As we descend into a devastating economic crisis, one that Barack Obama cannot halt, there will be tens of millions of Americans who will be ruthlessly thrust aside. As their houses are foreclosed, as their jobs are lost, as they are forced to declare bankruptcy and watch their communities collapse, they will retreat even further into irrational fantasy. They will be led toward glittering and self-destructive illusions by our modern Pied Pipers—our corporate advertisers, our charlatan preachers, our television news celebrities, our self-help gurus, our entertainment industry and our political demagogues—who will offer increasingly absurd forms of escapism. The core values of our open society, the ability to think for oneself, to draw independent conclusions, to express dissent when judgment and common sense indicate something is wrong, to be self-critical, to challenge authority, to understand historical facts, to separate truth from lies, to advocate for change and to acknowledge that there are other views, different ways of being, that are morally and socially acceptable, are dying. Obama used hundreds of millions of dollars in campaign funds to appeal to and manipulate this illiteracy and irrationalism to his advantage, but these forces will prove to be his most deadly nemesis once they collide with the awful reality that awaits us. |

|

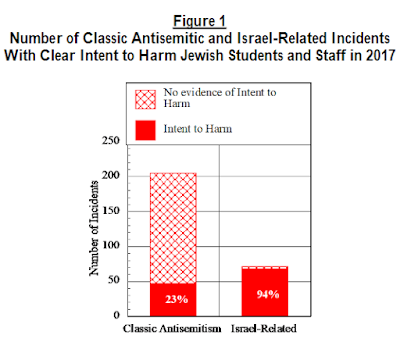

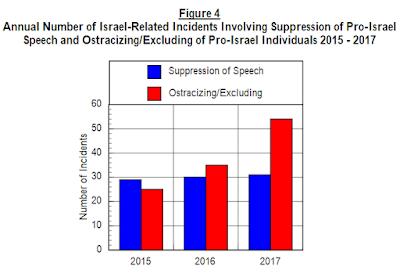

As On-Campus Denial of Anti-Zionism as Anti-Semitism Surges, So Do Attacks on Jewish StudentsBy Jewish Press News Desk 16 Tammuz 5780 – July 7, 2020 https://www.jewishpress.com/news/us-news/as-on-campus-denial-of-anti-zionism-as-anti-semitism-surges-300-so-do-attacks-on-jewish-students/2020/07/07/ AMCHA Initiative today released its annual report, Understanding Campus Anti-Semitism in 2019 And Its Lessons for Pandemic and Post-Pandemic U.S. Campuses, [ The researchers also found that Israel-related anti-Semitism is easily adaptable to the distance learning platforms that will likely play a large role in the college experience during the ongoing COVID-19 pandemic, and they unveiled a new approach to protecting Jewish students on physical or virtual campuses.